Olfactory sensory research in China as a part of sensory marketing

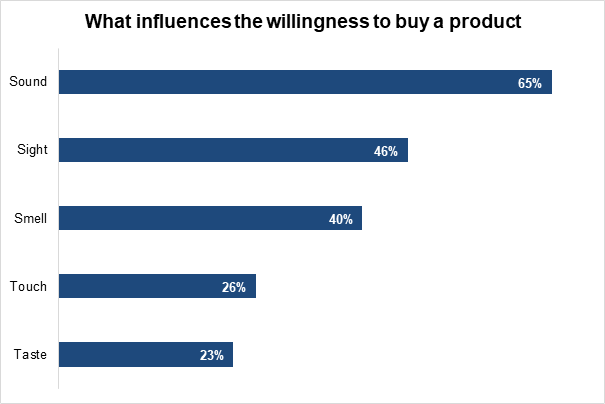

The beauty of sensory marketing is that the customer’s senses are managed without direct pressure on them. The buyer comes to the idea of buying or remembering a particular brand, guided only by emotions. Our sense of smell affects 75% of our daily emotions. The intimate connection between the olfactory gland, which registers smell, and the limbic system, which controls emotions and memories, is the force behind our sense of smell. Humans can recognize about 10,000 different smells. According to Sense of Smell Institute, people can remember smells with an accuracy of 65% after a year, as opposed to only 50% of the visual effects after three months. In addition, if a purchase is accompanied by a pleasant smell to a person, then the willingness to purchase the product increases by 40%. Therefore, the scent gradually becomes a part of the brand image and can help promote a product.

Why olfactory sensory research in China is important

As a rule, the ultimate goal of olfactory sensory testing in China is to make the product more popular and increase its marketing characteristics such as overall liking, credibility, buying intentions, etc.

Olfactory sensory testing in China is good for the situations when the product became boring to consumers and began to yield to its competitors in the market or when a new product is designed for the Chinese market.

At the initial stage, it is necessary to determine the problematic aspects of the available product option using a comparative study. At this stage, Daxens studies the existing version along with the products of competitors.

The process of olfactory sensory research in China

Create a study design

The first step is to decide how to implement sensory research. There are many ways for that. For example, Daxens can use the sequential monadic test when testing two or more products. With this approach, each respondent rates several products, but not necessarily all. The order in which focus group rates each product is random.

The testing procedure changes according to the requirements of the specific study. For example, the type of product can limit the number of samples. In addition, Daxens team considers other factors such as the amount of time to test participant.

Define the methodology

The next step is to define the methodology of sensory research in China. There are differential qualitative methods for olfactory sensory testing in China. Duo-trio test is the method for evaluating two pairs of coded samples by comparing them with a designated standard sample. Paired comparison based on the ranking of 2 coded samples includes focus group to determine in each pair a sample the most attractive one, for example, in terms of aroma intensity. A-not-A method of olfactory sensory research in China consists in the taster’s identification of tested samples (“A” and “not A”) in the proposed series of coded samples. Rank method is a marketing research method for evaluating coded samples by placing them in a row in the order of the intensity or severity of a given product characteristic.

The methodology also can include the following stages: 1. Selection of a combination of aromas that evoke positive emotions in buyers, and the identification of the degree of intensity of its impact on the basis of studying the associative olfactory series (AOD) of the target audience. 2. Formation of a positive event (memory) among the target audience when exposed to this combination of aromas. 3. Calling the necessary positive association among the target audience when exposed to the developed combination of aromas in a given place at a given time, stimulating the purchase of a particular product.

Select the respondents

There are several types of respondents for the focus group. Naive consumers are typically people who have not participated in consumer / marketing research in the past 6 months. Typically, the naive consumer displays honest emotional responses to general and specific characteristics of the product. Experienced consumers are those who have been repeatedly involved in various consumer research and have become “experienced” testing participants. Trained sensory panelists are the participants trained to take an analytic approach to product evaluation and therefore differ from consumer information. They have received specific training in sensory analysis, which provides quantitative description of products.

Create a questionnaire

In olfactory sensory research in China, the questionnaire is the main means of communication with the consumer. For effective feedback and from consumers, the structure of the questionnaire, the questions asked, the order and method of asking questions are of decisive importance. The questionnaire focuses on the aspects most relevant to consumers. Sensory data show what customers think about specific product characteristics.

Choose the location for olfactory sensory research in China

Daxens team can provide the research facility for olfactory sensory testing in China. The choice of facility depends timing, type of product tested, number of prototypes to test, real conditions of consumption, etc.

On the one hand, In-Use Test (e.g. at home, in a car, in a restaurant, etc.) is less convenient for product developers. On the other hand, the testing in a special facility can be more expensive. Anyway, the environment must match the evaluated products.

Statistical analysis

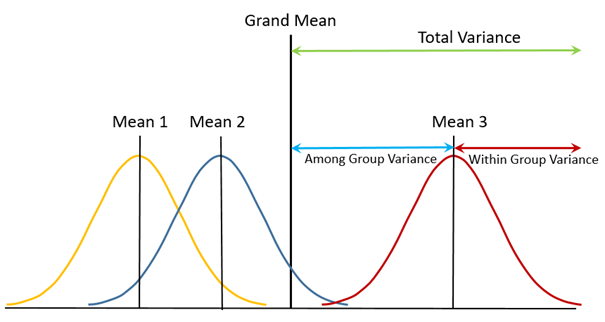

Studies with more than two products use Analysis of Variance (ANOVA) to evaluate different prototypes in relation to each other. The sensory specialists of Daxens team can define the areas for improvement and statistical differences between samples.

How to use olfactory marketing in China

We can identify the following promising areas of using olfactory sensory research in China:

- aroma branding – the development of an olfactory identity and its implementation at various points of contact: points of sale, advertising materials, etc.;

- advertising campaigns using flavored stands on city streets;

- aroma merchandising – attracting the attention of end customers to certain product categories using different scents;

- addition of aromas to advertising prints, souvenirs

New Balance case

The American brand New Balance entered the Chinese market through in-store sensory marketing. They used nostalgic scent of wood and leather to reinforce the sense of heritage and craftsmanship with which New Balance shoes are made. Customers spent twice as much money compared to similar stores in other locations, the atmosphere made them stay longer.

However, many companies may face such a challenge as the difficulty of using the olfactory emotion module (OEM), which lies in the huge variety of scents and consumer reactions to them. In most cases, the mistake of companies is that the fragrances they select make the buyer linger in the store, but do not stimulate his desire to buy the product.